Have you heard of Planck’s principle?

It is the idea that scientific revolutions do not start among the established scientists. Instead they are the result of younger scientists with new ideas taking over when the older generation goes away.

In other words, change in dominant ideas come from demography.

This applies to Bitcoin...

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great! Now let’s dive in.

Demography

If you want to know where Bitcoin will be 10 years from now don’t look at the dominant ideas today.

Warren Buffet is not going to invest in Bitcoin miners. Peter Schiff is not going to convert to Bitcoin. Most of the baby boomers who have only known the 60/40 portfolio will never consider investing in digital assets.

People get comfortable with the ideas that have been around them for the longest. Once those ideas are set it is very hard to change people’s mind.

That’s just the nature of things.

So, no. To see where Bitcoin is going you need to look at what the younger generations think. They are the ones who will eventually take over and dominate the future.

Now there is only a limited number of surveys tracking sentiments around Bitcoin. But if you read this data from Blockchain Capital things are encouraging.

Let me focus on one of the questions in the survey (but you should definitely read the rest by yourself).

Regarding the statement “it is likely most people will be using Bitcoin in the next 10 years”:

56% of the 18-34 years old agree.

57% of the 35-44 years old agree.

43% of the 45-54 years old agree.

25% of the 55-64 years old agree.

20% of the 65+ years old agree.

You can see the pattern right?

The younger the age group the more positive the sentiment on Bitcoin. This is just one of a few questions in this particular survey, but this trend holds for all of them.

Ok. Sentiment is good.

Well it turns out this good sentiment is likely to translate into a large inflow of money into Bitcoin for the next 10 to 20 years.

Why? Because demography.

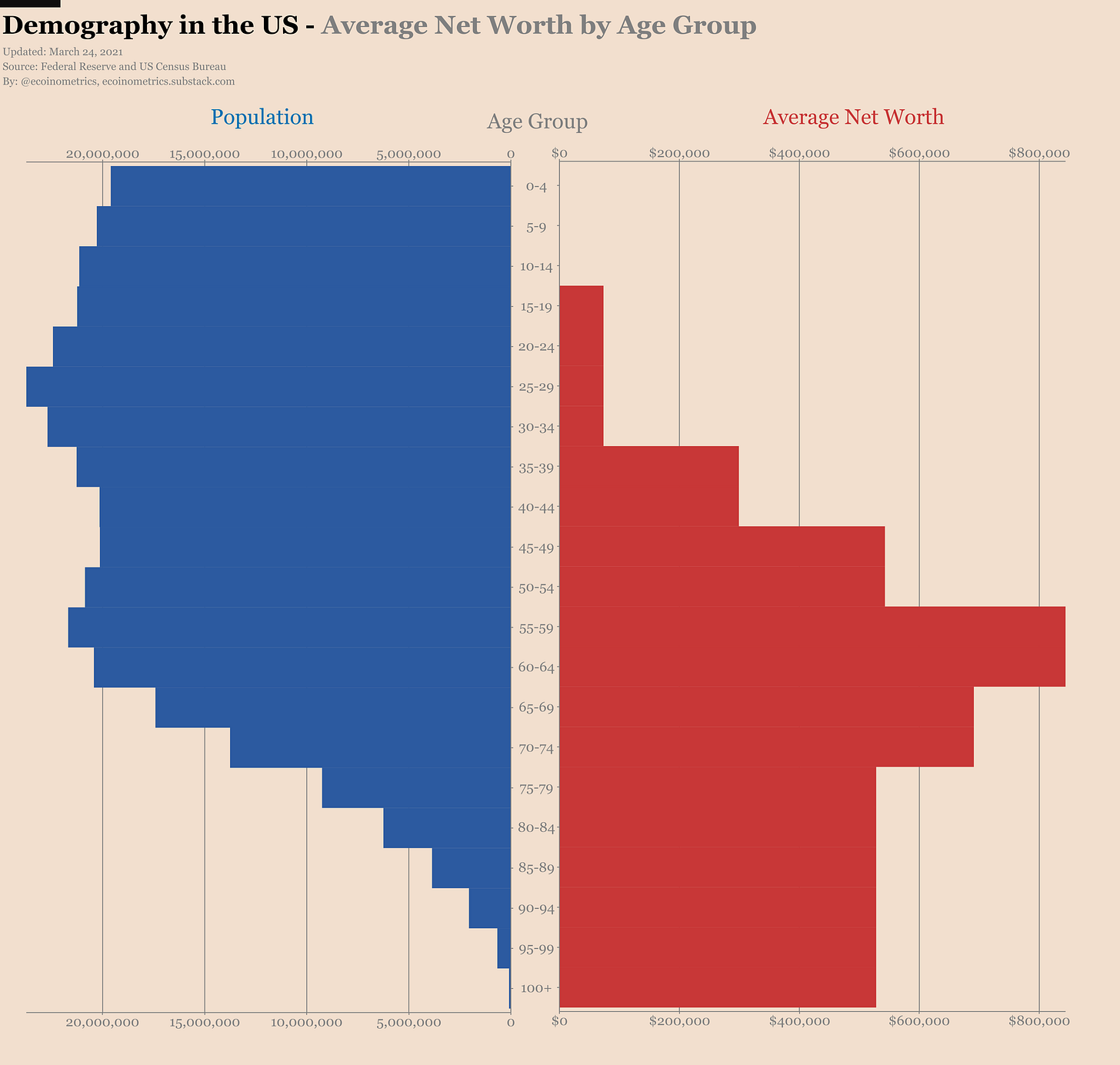

Below I’ve pulled the most recent data (2019) of the population distribution in the US:

In blue on the right side of the graph you have the population in each age group.

In red on the left you have the median income in each age group.

Regardless of the particular epoch, it is true that people tend to earn more as they get more senior.

So what you can infer from this chart is that in the next 20 years the large bump of people who are currently aged 20 to 40 years old are going to move into the age zone at which their income is expected to peak.

More income correlates to more money to invest. And given that this new generation is more favourable to Bitcoin that also means more money trickling down to BTC.

But wait, there is more!

Checkout the same graph where I’ve switched the median income for the average net worth in each age group.

Notice the large spike in net worth for the 55 to 75 years old age group. Most people in this age group have no interest in Bitcoin.

However, as they get older, they are bound to transfer their wealth to the younger generation. Again some of this is going to trickle down to Bitcoin...

It is hard to evaluate how much money will flow into the space as the new generation takes over. But demography is a significant force and there is no doubt it is shaping out the future of Bitcoin.

So tl;dr demography is a tailwind for Bitcoin. Position yourself accordingly.

Drawdown

Bitcoin hasn’t made a new all time high in a week… so it is time for the obligatory “it’s just a drawdown don’t panic”.

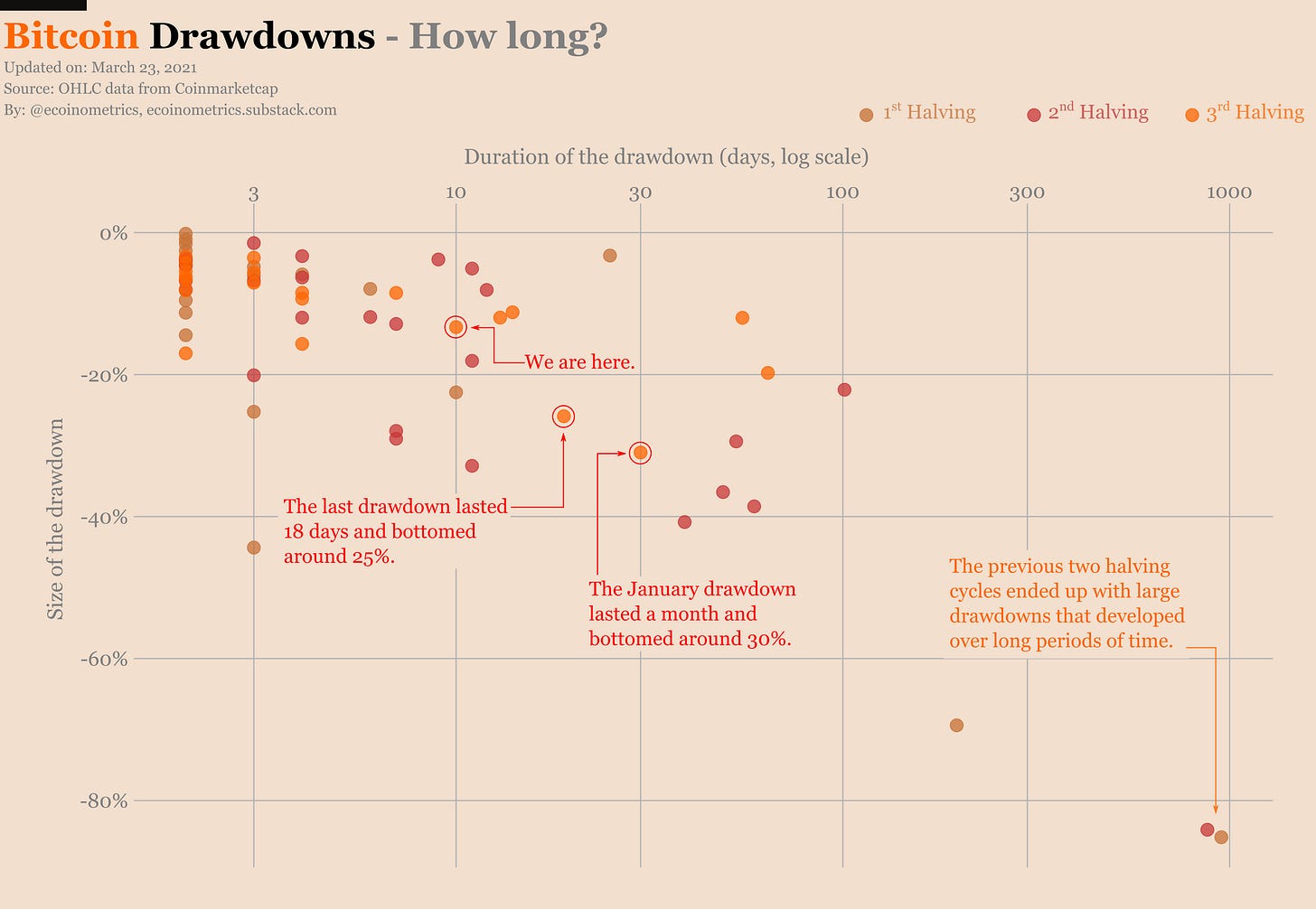

Using the previous halving cycles as a guide, pullbacks are pretty common during the bull market that follows the halving events.

Some of those pullbacks can be relatively large (more than 20% dip from the top) and last longer than you’d expect (a few weeks to a few months). Yet they aren’t a sign that the market is dead.

So how is this current drawdown doing when compared to the historical data? As I write those lines:

We have been in a drawdown for 11 days.

The bottom is -16% from the all time high.

Check it out.

The previous two pullbacks lasted three weeks and one month respectively but found their bottom much lower.

As far as the past can be used as a guide to the present:

You’ll be lucky if you can buy the dip around $51k (70% of the pullbacks won’t take you lower than that).

You’ll be very lucky if you can buy the dip at $46k (80% of the pullbacks won’t take you lower than that).

And if you buy the dip at $40k then you are a champ (90% of the pullbacks won’t take you lower than that).

See for yourself.

You don’t need to rely solely on those stats to decide what is the best level at which to buy the dip. But it’s worth keeping those numbers in mind.

For a more fully fleshed discussion of pullbacks during bull markets checkout these two issues of the newsletter here and here.

CME Bitcoin Derivatives

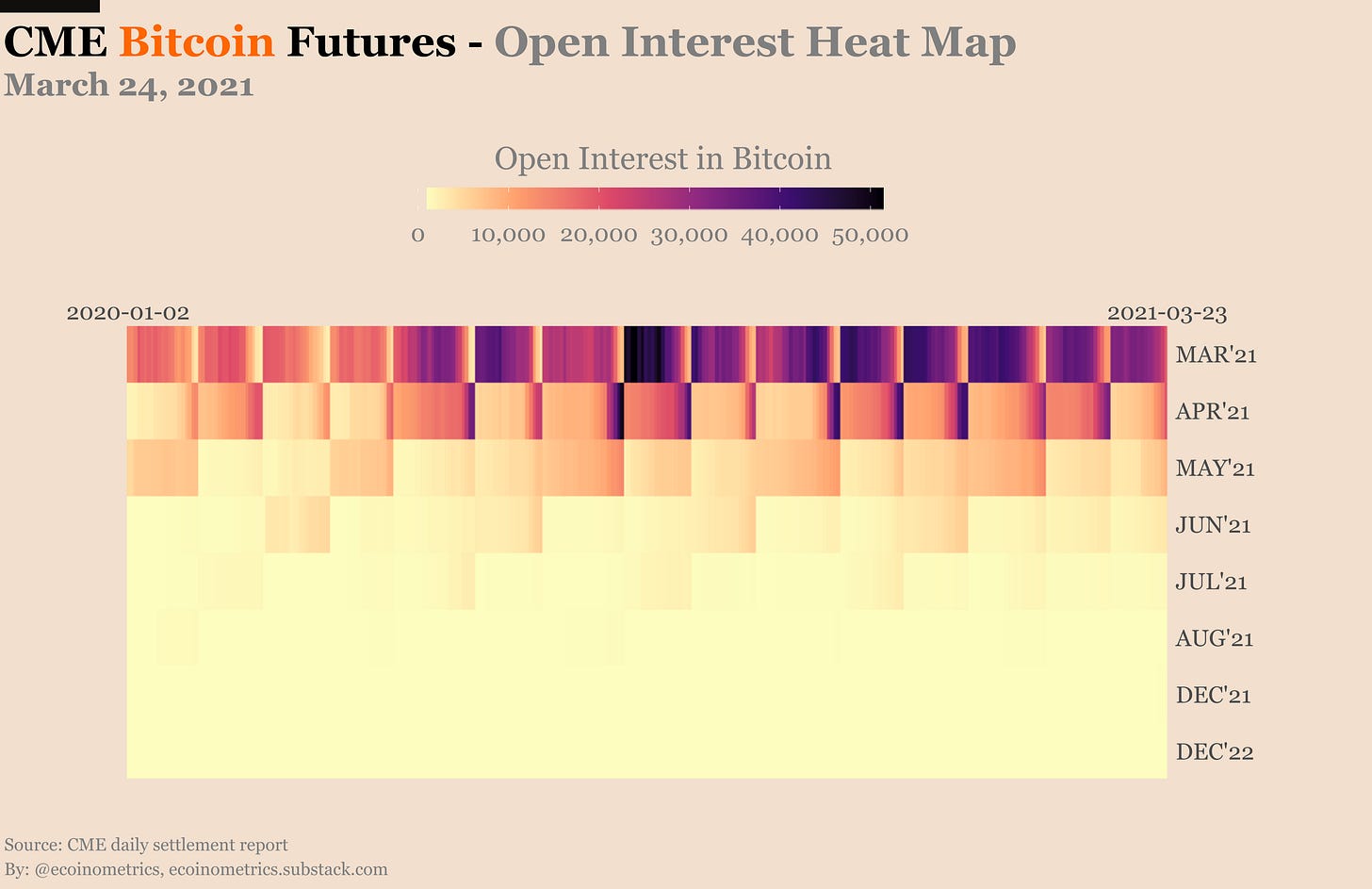

There are only a few days to go until the March contracts expire. The rollover is well on its way as you can see on the heat map.

No significant increase in volume around that event but the open interest is on the rise.

Taken alone that doesn’t mean much. Could be just a technical rise accompanying the rollover. But it could also be that some people are buying the dip.

I mean, last week’s Commitment of Traders data shows that the retail traders are adding to their long positions (+500 contracts). So maybe...

By comparison the smart money isn’t doing much. After all, why change anything to the basis trade if you are printing money.

On the options side of things, the puts to calls ratio is as balanced as it has been for a loooong time: 3 puts for every 4 calls.

You can see that the market activity is very sluggish though. Sure, traders are buying more protective puts that they have done in the past. But these are small positions.

It looks like if Bitcoin remains around $55k at the end of the week we’ll get:

74% of the calls expiring in the money.

3% of the puts expiring in the money.

But the important number is that a total of 62% of ALL the open contracts on the CME Bitcoin options market are going to expire in three days… we are going to be left with a really small number of positions.

I don’t want to sound like the options market is dying but, yea, it doesn’t look very good.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do two things:

Click on the subscribe button right below.

Done? That’s great!