It seems that Bitcoin is getting boring these days. No trend. No big moves. No news except for the same FUD that has been repeated for years.

So is Bitcoin dead? Is Bitcoin becoming like your average stock? Well, let’s look at the market conditions to see if there is anything new.

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Updated Market Conditions

October is coming and Bitcoin remains in the drawdown that started last April. That’s still not the longest drawdown we have seen in a post halving bull market, but it is getting pretty close.

Earlier this year things were looking pretty good and for a while it was a fair guess to think that we’d get the same kind of cycle as we had in the past.

Now clearly BTC is getting way behind the 2017 growth trajectory.

See for yourself.

So a lot of people who bought in the past year expecting that we’ll be at $200k in October are starting to doubt their position.

And if your thesis to go long Bitcoin was that the post-halving bull market would be a repeat of 2017 then it totally makes sense. That hypothesis is now invalidated.

But does that mean Bitcoin is dead though? Does that mean you should sell now and move on with your life?

Well my opinion is no. If you are playing the long term game, there are no reasons to be particularly worried about the lack of trend at the moment.

Why?

Let’s just look at some market metrics to get an idea on where we stand.

First, are people still buying Bitcoin? It seems the answer is yes.

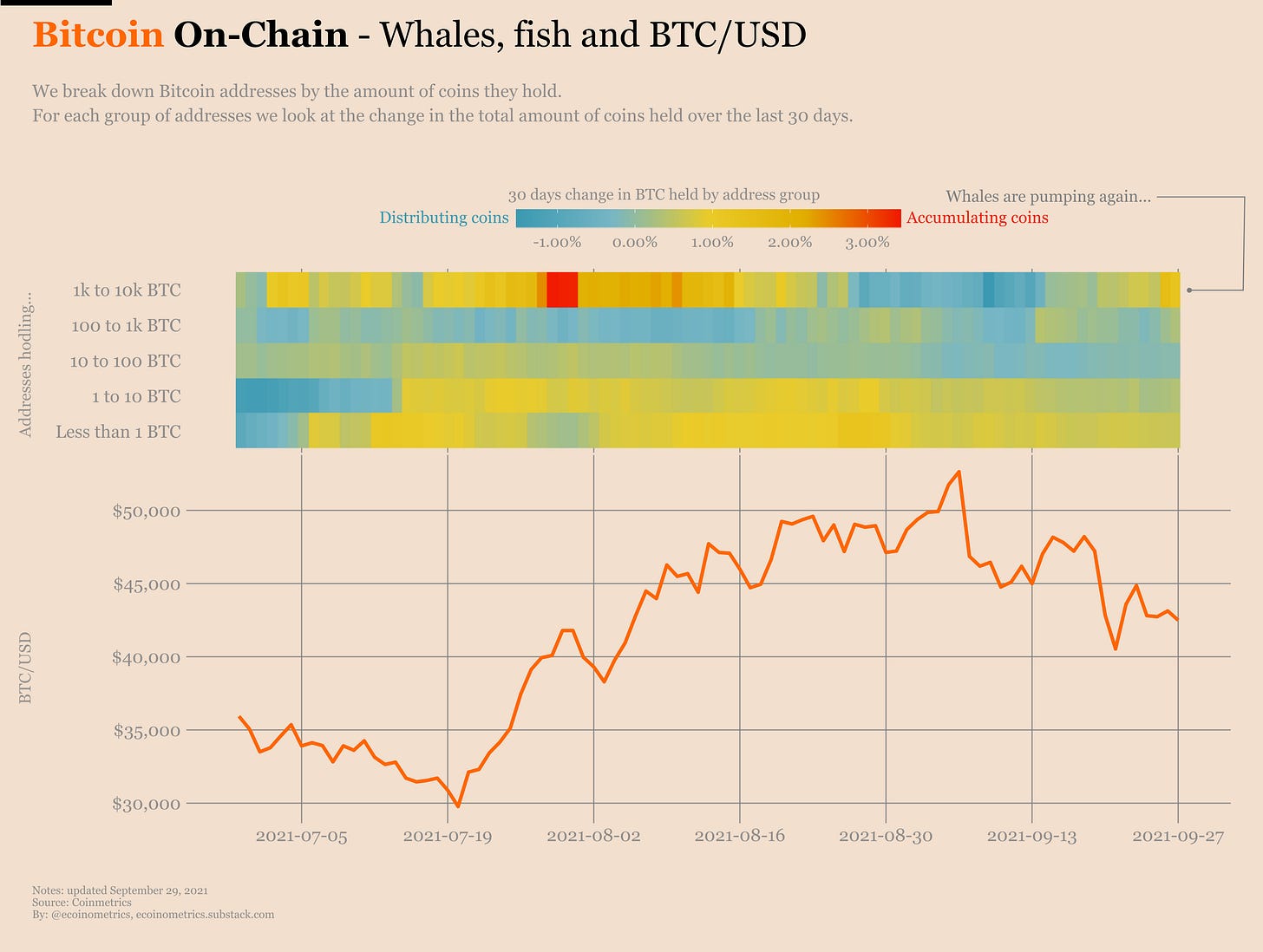

One thing I like to track on-chain is the accumulation trend. You break down the Bitcoin addresses in buckets based on how many BTC each address controls. Then you simply look to see if each bucket is growing (accumulating coins) or shrinking (distributing coins).

That gives you an idea of where coins are flowing and what the small fish and whales are up to.

Right now:

The small fish (addresses controlling less than 1 BTC) are constantly buying more coins.

The whales (addresses controlling 1k to 10k BTC) are loading up on coins at around $40k.

Take a look.

Actually the small fish are almost back at accumulation levels last seen when BTC topped at $64k, except that now we are $20k lower.

And if you expand the chart above to look at all the buckets, the big picture is pretty clear:

Below 10 BTC, addresses are accumulating.

Between 1k and 10k BTC, addresses are accumulating.

For the rest, everything is pretty much flat.

So this is not like there are people in the know who are dumping heavily on retail investors.

We see signs that people at both ends of the scale are accumulating, it is just that the rate of accumulation is slow.

When you combine that with the fact that exchange outflows continue to dominate the inflows, it all points to one thing: the supply of coins readily available to purchase is shrinking.

Sure, if more people were to participate in the accumulation trend this supply would shrink even faster. But at least for now the participation score remains just above the blue zone which is good but not great.

On top of that it is rather unlikely that the majority of hodlers would want to cash out at the current price level.

If you look at the market value to realized value ratio (MVRV, full explanation here) you can see that right now Bitcoin is sitting around 2.

What that means is that as a whole the participants in the market are up 100% on their Bitcoin positions.

Those are rookie numbers in this racket.

Maybe some institutional investors will be content on cashing out after a 2x but my guess is that most people who invest in Bitcoin expect more.

That makes me think we are just building up for the next wave right now. At least that does not make me think that the market is in full bear mode.

Alright, that’s good. All this on-chain data gives us very valuable information about the situation on the supply side. What about the demand then?

I mean even if the supply is shrinking, if there is less demand overall the price is unlikely to pump.

What are we waiting for exactly? I don’t know.

You’d think that at least a bunch of institutional investors would want to try to front-run a possible green light on a Bitcoin ETF by the SEC in October. That might be an additional source of buying pressure in the weeks to come.

But it could also be that a lot of people are holding on to their dry powder while waiting to see what the Federal Reserve will do. The monetary regime risk is there, and based on the timing and sizing of the tapering of their asset purchase program chances are we could get a stock market downturn.

When these things happen, all assets are impacted in the short term, including Bitcoin.

Tl;dr the supply situation from on-chain data is bullish for Bitcoin.

That being said, the broader market risk regarding what the Fed will do in the coming months is likely to keep demand low as investors are in a wait and see mode.

But overall there are no reasons to think that the macro trend won’t play out eventually.

CME Bitcoin Derivatives

Apparently the Bitcoin derivatives traders on the CME don’t share my enthusiasm about those on-chain metrics.

Retail traders aren’t getting into more long positions. They even have opened a few more short positions.

The smart money is doing nothing.

And even splitting the data between hedge funds (which are typically running an arbitrage strategy on the futures) and asset managers it looks like everyone is asleep at the wheel.

Options traders are even positioned bearish. There are twice as many puts open than calls and a load of those puts are between $30k and $40k.

So again, we are stuck in this middle ground market that has no sense of direction. Let’s see what it will take for that to change.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick