Ecoinometrics - Aggregate Risk

October 11, 2021

There is a lot of indicators that you can look at to get an idea of how much risk there is in the market.

How about we combine them to get a high level view of the aggregate risk in BTC?

The Ecoinometrics newsletter decrypts Bitcoin’s place in the global financial system. If you want to get an edge in understanding the future of finance you only have to do one thing, click on the subscribe button right below:

Done? Thanks! That’s great! Now let’s dive in.

Aggregate risk

If you read this newsletter regularly you have noticed that we look at a lot of different metrics to get an idea of what’s going on in the Bitcoin market.

There is the 200 days moving average, the market value to realized value ratio, the on-chain accumulation trend, the behaviours of whales, the participation score, the growth trajectory with respect to the previous cycles, the net exchanges flow, the broad risk level in the stock market…

On one hand, if you want to get a full picture of the market, there is no way around it. Each metric gives a different set of information and you need to look at them individually to understand the nuanced stories they are telling.

On the other hand, sometimes you just want a high level picture without having to dig into the details. So that would be nice if we can somehow combine a bunch of metrics and get something that alerts us when the market is running really hot.

For sure by taking averages and combining different types of metrics we’ll be losing the details. But it is always time to dig deeper after you’ve been alerted that something is amiss.

Now I like to keep things simple. So we aren’t going to combine 50 different indicators together. Instead let’s handpick a few that represent different kinds of market risk.

The first kind of risk we can measure is how overextended the market is. That is how far is the price deviating from its long term trend.

The natural way to measure that is to look at the ratio of the BTC price to its 200 days moving average (also known as Bitcoin’s Mayer multiple for historical reasons).

Actually instead of looking at the multiple directly, we instead look at where the current 200 days multiplier stands in comparison to its historical distribution.

Example, right now BTC is at 1.22x its 200 days moving average. This 1.22 value corresponds to the 58th percentile of its historical distribution. That means we are in the middle and everything is fine.

If we had a value that was at the 90th percentile, that would mean the multiple has been higher only 10% of the time in Bitcoin’s history. That would be an indication that the market is running hot.

So tl;dr: high percentile (red) means high risk and low percentile (blue) means low risk.

Take a look.

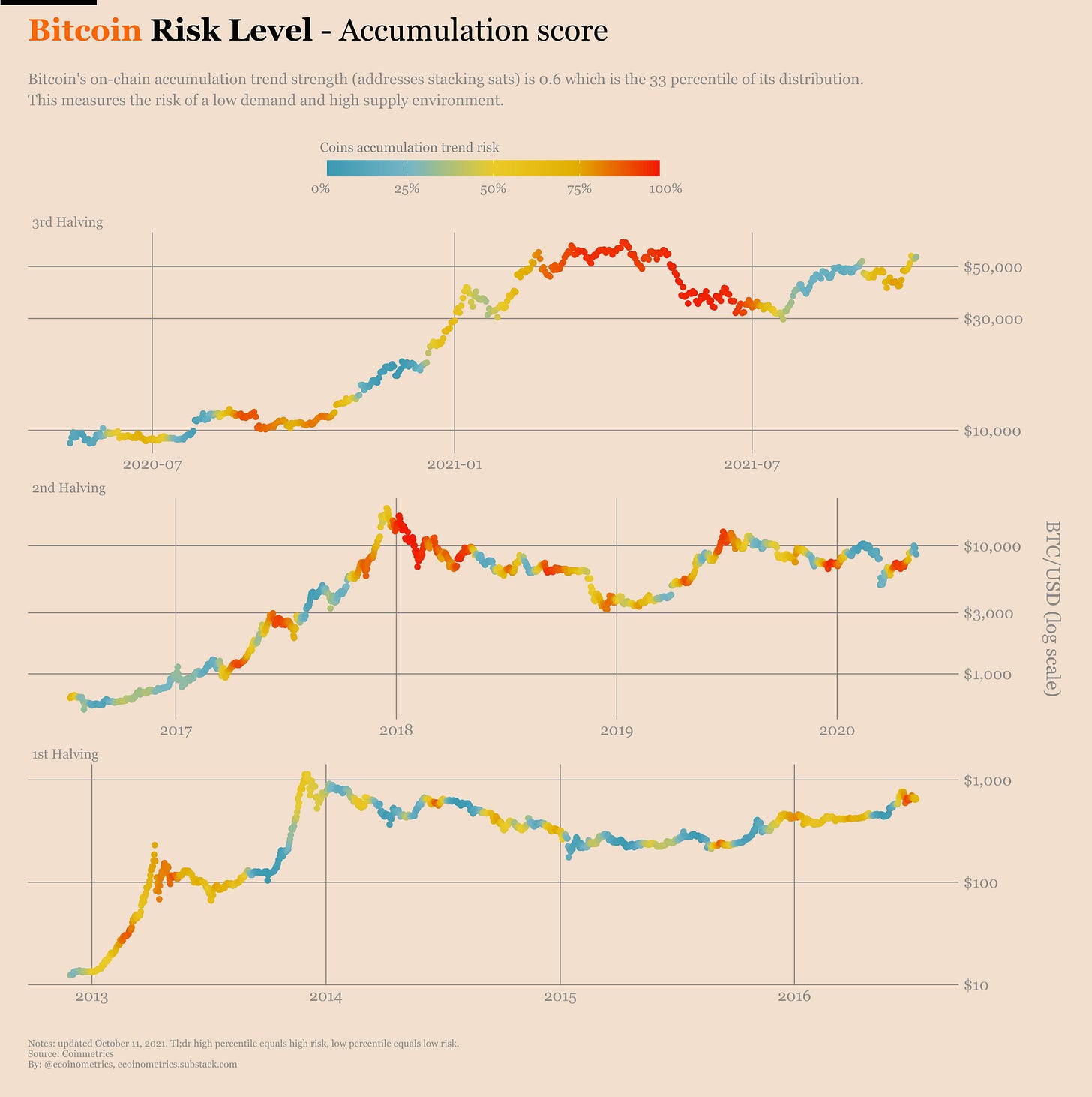

The second risk we can look at is the risk of a low demand and high supply environment. That’s basically what the on-chain participation score tries to measure. This metric looks at who (from small fish to whales addresses) has been accumulating coins over the past 30 days and builds a score between 0 and 1 out of it.

A score of 1 would mean everyone has been stacking sats over the past month. That would be a sign everyone wants to accumulate coins on-chain i.e. high demand and low supply. Which is a low risk environment.

A score of 0 would mean no one has been stacking sats. That would be a sign that there is no demand for BTC and all transactions happen within exchanges. Which is a high risk environment.

In order to normalize this metric we can use the same trick as for the Mayer multiple. Instead of looking at absolute values, we work with the historical distribution and make it so that a high percentile corresponds to high risk and low percentile corresponds to low risk.

The result looks like that.

Something else we might want to look at is how likely is it that hodlers are going to take profit?

I mean, not everyone is equipped with diamond hands. Some people will be tempted to cash out once they have made life changing returns. That’s natural.

Turns out the likelihood of that happening to a lot of people can be measured by the market value to realized value ratio.

The higher the ratio, the more hodlers are sitting on large unrealized gains and the more likely they are to sell.

So we do the same trick here and look at the profit taking risk by comparing the current market value to realized value ratio to its historical distribution.

Here is the picture.

Finally we want to gauge the risk of high selling pressure. Typically if a lot of Bitcoins are being moved to an exchange, it is because people are getting ready to sell their hodlings. So looking at the net flow towards exchange wallets over the past 30 days can alert us of an increased selling pressure.

This is what I’ve charted below.

Alright. So we have our list of “risk scores”, represented as percentiles of their historical distribution, covering the following:

Risk of overextended market.

Risk of low demand, high supply situation.

Risk of hodlers taking profits.

Risk of increased selling pressure.

Let’s define the aggregate risk level of the Bitcoin market as the weighted average (30%, 30%, 30%, 10%) of the risk scores above.

See for yourself.

Seems to be working well enough. Historically an aggregate risk above 80% has done a good job at signalling the top of the big moves.

Something missing from there is the risk of a stock market crash. It is true that Bitcoin is uncorrelated to the stock market over long periods of time. But as we’ve discussed before, liquidity events created by stock market crashes affect all markets so it would be nice to take that into account. That’s work for another day.

Currently Bitcoin sits at an aggregate risk score of 53%. That’s very “middle of the road” which means there is nothing in particular to be worried about.

Let’s just wait for the next parabolic move...

Market sentiment

The results of last week’s price prediction poll are out.

The consensus is that Bitcoin will rise to $60k by the 3rd of November. So once more you guys are reasonably bullish.

For Ethereum’s the story is the same. It looks like the consensus is that ETH is to remain strongly correlated to BTC in the near future.

Here is the link to today’s poll for your predictions on the price of BTC and ETH on November 11:

https://forms.gle/YTYNuRDkpLjLogW69

After we have collected enough data in a few weeks I’ll do a deeper analysis of the results. In the meantime continue to share your predictions every week and pass the link around so that we get as many responses as possible.

That’s it for today. If you have learned something please subscribe and share to help the newsletter grow.

Cheers,

Nick

Thanks so much, Nick, for the extremely useful info (as usual). The Aggregate Risk indicator is killer! Any plans to make it available as a live indicator somewhere? If so, please keep us posted :)

Keep up the awesome work 👏👏

Such an amazing article. Tbf so is every weeks. Thanks for taking the time to break down in such a clear manner